Reconcile an account in QuickBooks Online

Verifying balances helps to identify any discrepancies between the bank statement and the Quickbooks Online records, ensuring that the financial data is reliable for decision-making. Making adjustments based on these checks helps in rectifying any errors and aligning the records accurately. This crucial step ensures that the financial records are accurately balanced with the bank statements. Once the account is selected, users are guided to review and match the transactions in Quickbooks Online with those in the bank statement.

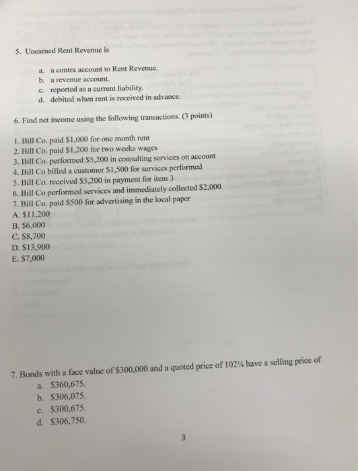

Step 4: Enter any missing transactions identified in steps 2 and 3 into the check register

Second, it provides a clear picture of your financial health, giving you updated insights into your income, expenses, and overall profitability. This information is vital for evaluating your business performance and planning for growth. A recent survey suggests employee turnover that 72% of self-employed contractors do their own accounting. If you’re among them, it’s crucial to understand what reconciliation is and how to do it right. After you reconcile, you can select Display to view the Reconciliation report or Print to print it.

Compare both adjusted balances

These transactions, including customer deposits, interest income, and any other additional funds, are essential for maintaining an up-to-date understanding of the company’s financial position. By including details such as check deposits, wire transfers, and electronic payments, this section provides a clear overview of all inflowing monetary activities. It ensures that all cash transactions are accounted for and justified. Without preparing a timely bank reconciliation, you risk your business losing cash without you knowing.

What Information Does The Bank Reconciliation Report Show?

Simply select the ‘Banking’ category and then choose the ‘Bank Reconciliation’ report option. This will open the bank reconciliation report, where you can input the necessary details to generate the report for your financial records. Once you have your monthly bank or credit card statement, cheques to only remain valid for 3 months from april 2012 you can start reconciling. If you need to reconcile more than one month, do them one statement at a time, starting with your oldest statement. In QuickBooks Online, you can choose to reconcile any of your connected accounts, as well as bank accounts that are not connected.

Step 2: Go to the Reconciliation page

This starting point is essential for ensuring that all transactions, including deposits, withdrawals, and any outstanding items, are accurately accounted for. By comparing this initial balance with the ending balance reported by the bank, discrepancies can be identified and resolved, thus ensuring the accuracy and integrity of the financial accounts. By comparing the transactions in Quickbooks with those provided by the bank, business owners can identify any discrepancies and address potential errors or fraudulent activities. This process not only helps in maintaining the accuracy of financial records but also fosters transparency and trust, which are vital in the context of financial data management.

After completing the reconciliation, QuickBooks will generate a reconciliation report. This report provides a detailed record of the transactions withholding allowance definition you reconciled. The main difference is that you’ll be reconciling credit card transactions instead of bank transactions.

Just like balancing your checkbook, you need to review your accounts in QuickBooks to make sure they match your real-life bank and credit card statements. If that’s the case, all you need to do is record transactions in QuickBooks Online using the Expense screen above. Recording the expense will work to reduce the difference between your bank statement and your QuickBooks Online balance, providing you with your reconciled balance. The same process would need to be completed for deposits made but not recorded in the general ledger by posting them in the Receipts feature.

- In this blog post, you’ll learn how to “really” reconcile your bank accounts (and avoid this awkward exchange with your accountant).

- If the difference hits 0, congratulations, your account is reconciled.

- To complete the reconciliation process, you must verify that the difference is zero.

Let’s look at four common reasons why you might have to undo reconciliation in QuickBooks Online. Now, open the register for the account you are un-reconciling by hovering over Accounting on the left-side toolbar and then selecting Chart of Accounts. Remember, reconciliation is not a one-time process but an ongoing practice that you should do at least once a month.

If you want to reconcile your checking account, you would just choose checking from the drop-down menu. You can also reconcile various asset and liability accounts using the reconciliation feature. If this is the first time you’re reconciling this account, the beginning balance in QuickBooks will be zero.

When you create a new account in QuickBooks, you pick a day to start tracking transactions. You enter the balance of your real-life bank account for whatever day you choose. We recommend setting the opening balance at the beginning of a bank statement.

This can lead to a number mismatch, leading to unmatched transactions. The opening balance and date are automatically detected based on the ending balance and the date of the previous reconciliation. Unlock the power of merchant services for your business with our comprehensive guide.

A monthly reconciliation helps to catch and identify any unusual transactions that might be caused by fraud or accounting errors, especially if your business uses more than one bank account. Connect QuickBooks to your bank, credit cards, PayPal, Square, and more1 and we’ll import your transactions for you. When you receive your bank statement or account statement at the end of the month, you’ll only spend a minute or two reconciling your accounts. QuickBooks organizes your data for you, making bank reconciliation easy. As you review your bank statements and QuickBooks, select each transaction that matches. You can also confirm you reconciled a transaction by running a reconciliation report and finding the transaction in question.

You may need to go back to previous months to locate the issue. Sometimes your current bank account balance is not a true representation of cash available to you, especially if you have transactions that have not settled yet. If you’re not careful, your business checking account could be subject to overdraft fees. The first procedure in reconciling is tracing the bank statement line items to the check register. On June 15, we had a cash deposit of $5,400 with reference number 2297.

QuickBooks Online vs. QuickBooks Desktop allows you to access your financial data from any device. It’s best suited for ecommerce and web-based businesses that need seamless accounting integration. Select Start Reconciling and carefully match each transaction in QuickBooks to your bank or credit card statement. Check off each transaction in QuickBooks that matches your statement.

This frequency of running reconciliation reports is crucial in managing the sheer volume of daily transactions that businesses deal with. It allows for timely identification and resolution of discrepancies, helping to prevent potential financial errors or misstatements. It’s recommended to reconcile your checking, savings, and credit card accounts every month. Once you get your bank statements, compare the list of transactions with what you entered into QuickBooks. If everything matches, you know your accounts are balanced and accurate.